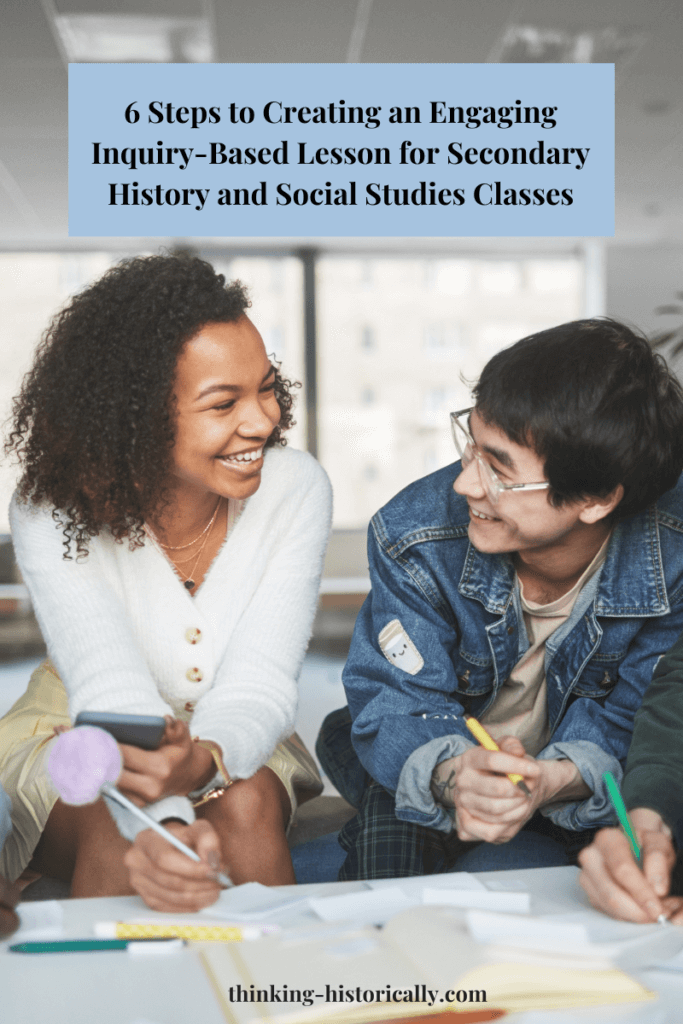

As a high school economics teacher, you might be stuck with planning curriculum and may be wondering what else to cover? When I first taught economics, I basically taught my students about supply and demand the whole semester because I didn’t know what else to teach (woops. Lol.) Needless to say, my students did not enjoy my class that year and neither did I! The great news is that your class doesn’t have to be like mine was. You can make economics fun, engaging, and relevant for your students by incorporating financial literacy into your economics curriculum!

Your high school students will love talking about money and becoming financially literate as they gain helpful skills they can use beyond the classroom.

In this post, I’ll talk about 4 financial literacy topics you can teach in your high school classroom. If you’re interested, you can purchase my Financial Literacy Lessons Bundle. This bundle includes 3 ready-made lessons and 1 project that you can use in your class right away!

If you’re not interested in purchasing, no worries! Keep reading about how these financial literacy topics you can teach in your economics class.

Financial Literacy Topic #1 – Budgeting

One financial literacy topic you can teach your students is budgeting. Sure, many students know what a budget is, but most often, they haven’t had to budget. For this activity, you can have students create a personal budget on their spending habits.

How to set it up

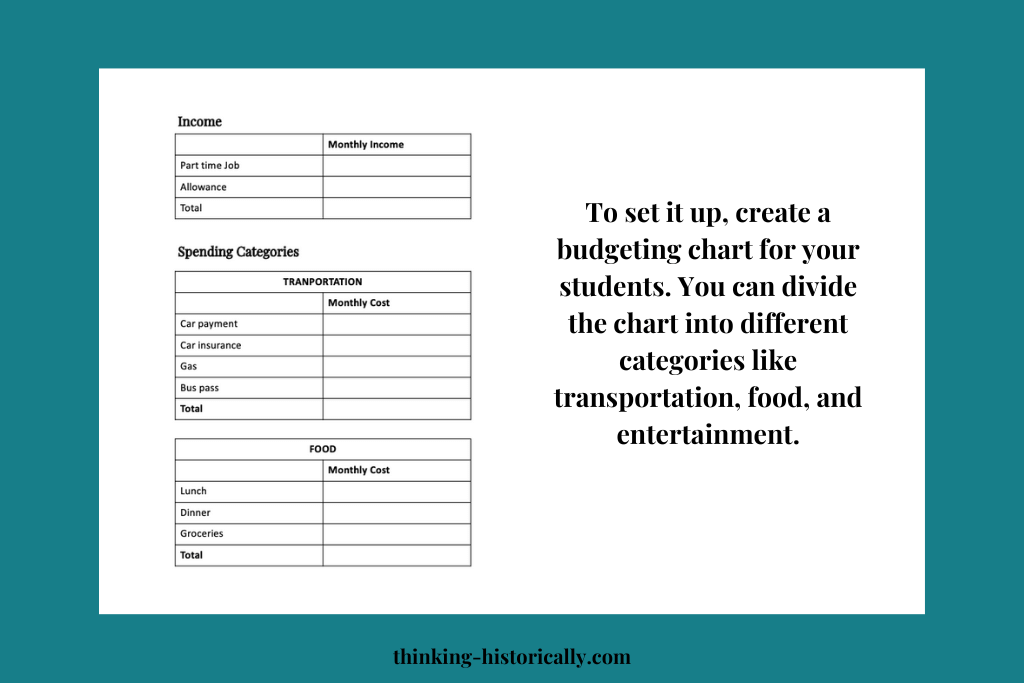

To set it up, create a budgeting chart for your students. You can divide the chart into different categories like transportation, food, and entertainment. Below is an example of a budgeting chart.

After giving students the budgeting chart, have students total their monthly income. Once they know their monthly income, they will be able to divide their money into different spending categories. When they are finished budgeting their money into different categories, students will add their monthly.

Sometimes, students realize that they are spending more than their monthly income allows and have to make changes to their spending habits.

An extension to this budgeting activity, would be to have students answer the following reflection questions after completing their budget:

- What did you learn from creating your personal budget?

- What changes, if any, do you have to make about the way you spend your money?

Financial Literacy Topic #2 – Savings Accounts

Another financial literacy topic you can incorporate into your curriculum is savings accounts. This is a fun topic to teach because most people (not just students) only really know of the savings account that is tied to their checking account. To be honest, I was one of those people (lol).

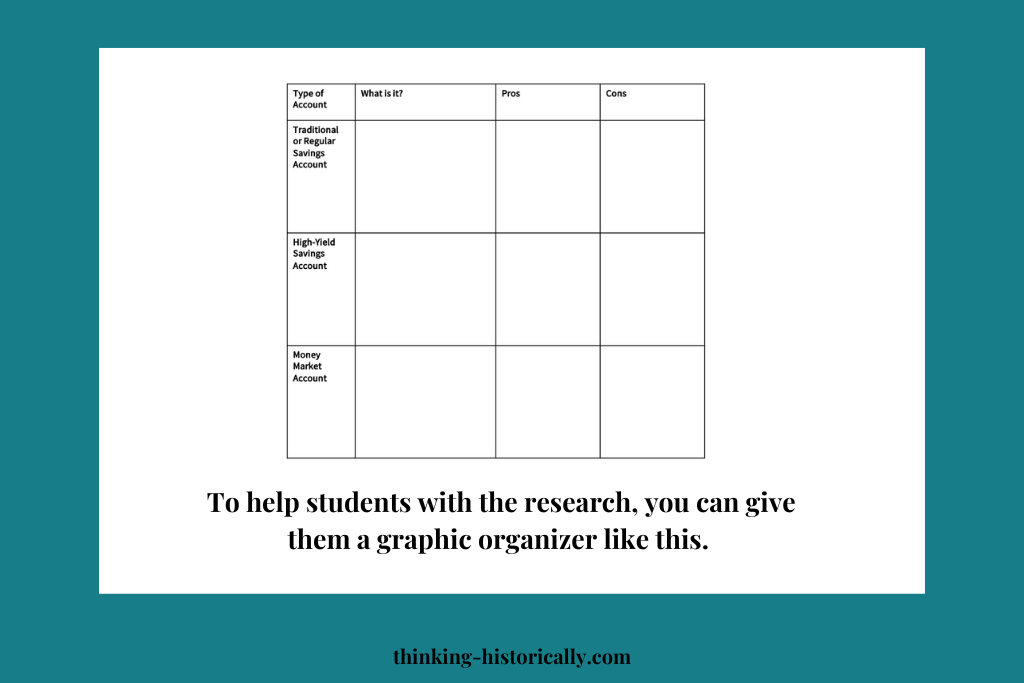

One activity you can do with your students is to provide them with a list of different types of savings accounts. Some savings account types are: traditional saving account, high-yield saving account, money market account, CD account, cash management account, and special savings account. Then have students research these types of accounts to identify the pros and the cons of each.

To help students with the research, you can give them a graphic organizer like the one below.

If you’re interested in developing a lesson around savings accounts, you can read “How to Teach a Financial Literacy Lesson on Types of Savings Accounts.”

Financial Literacy Topic #3 – Credit Cards

Credit cards is a great financial literacy topic to add to your economics curriculum! Most students know what credit cards are but don’t know that each credit card is different or the responsibility that comes with owning a credit card.

One way you can teach students about credit cards is by going over important terms associated with credit cards. Some credit card terms are: annual interest rate, compounding, delinquent payment grace period, finance charge, introductory rate, and annual fee.

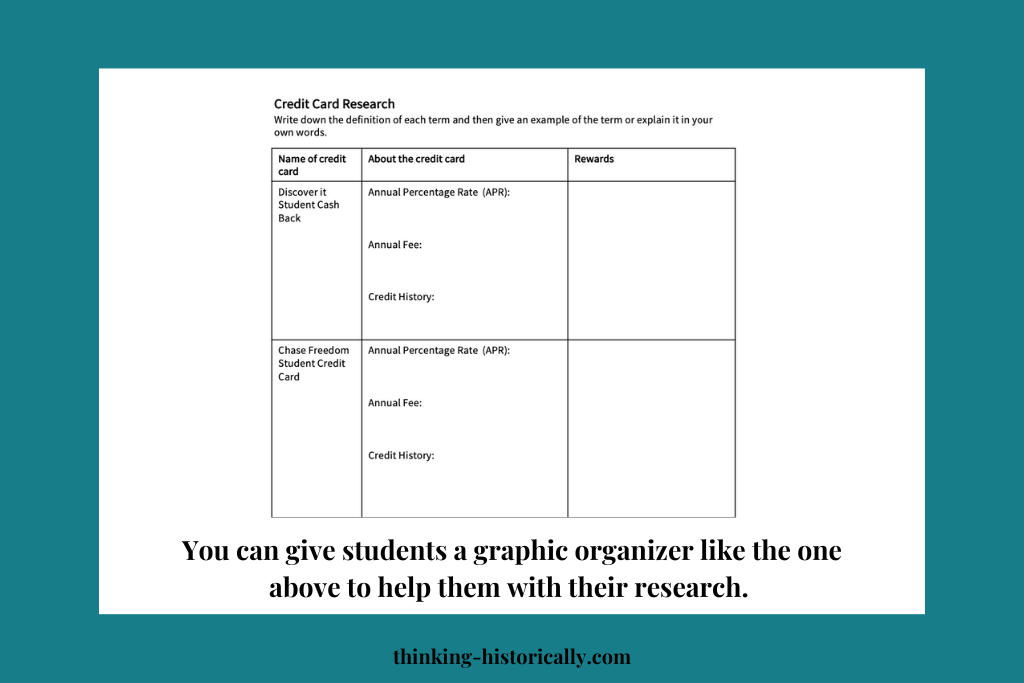

Then give students a list of different credit cards so that they can do internet research to figure out the annual percentage rate (APR), annual fee, credit history, and rewards for each card. You can give students a graphic organizer like the one below to help them with their research.

After students have completed, you can ask them the following question: Based on your internet research, which credit card would you apply for and why?

If you’re interested in learning more about this lesson, head over to “Credit Card Lesson for High School Students.”

Financial Literacy Topic #4 – College

The last financial literacy topic may catch you off guard, but a great topic to teach and include in your curriculum is “college.” Yes, college. You might be wondering, “How is college a financial literacy topic?” Well, it is a part of financial literacy because it is a big investment for both students AND parents.

For your class, you can have students complete a College Research Project for High School Students. In this project, students can research things like:

- The benefits of going to college

- Methods of paying for college

- Tuition and housing costs and different colleges

- Majors and Internship Opportunities and different colleges

Getting students to research colleges will help them make a better choice about which college fits their needs and wants. Oftentimes, students like a college only because their parents went there or because they like their football team.

These are 4 topics that you can include in your financial literacy curriculum! If you’re interested check out my Financial Literacy Lessons Bundle. This bundle includes 3 complete lessons (with ready-made handouts and complete lesson procedures) and 1 project about the topics in this post.

Happy teaching!