Economics financial literacy is an important life skill but most of us don’t learn about it until we’re forced to once we graduate high school and/or go to college and start working. To be honest, I didn’t open a credit card until midway through college. When I finally had a credit card I barely used it because I wasn’t sure how it worked.

Financial literacy is an important skill for life because knowing about it sets us up for success when making decisions about money and how to manage it. It is important that students start learning about it while they’re in high school so they are able to navigate the financial world once they graduate. Fortunately, if you’re a secondary economics teacher, you have an opportunity to introduce students to this important life skill! You might be wondering how to teach financial literacy to high school students…

As a secondary social studies teacher, I’ve been able to create lessons that will prepare students to make financial decisions! I’ll walk you through an economics financial literacy lesson!

A great place to start is by having students create their own personal finance budget! With a personal budget, students will be able to apply their understanding of wants and needs!

Economics and Financial Literacy Lesson

To begin this lesson, it is important to get students to start thinking about how they manage money. Warm-up questions that I asked my students were, “What do you do with the money you earn from your part time job or money you’ve received from your birthday? For instance, do you save your money, use it to go to the movies, or use it to hang with friends?” I think these are great questions because it gets students thinking about their “wants” and “needs” without directly asking them “what are you wants and needs?”

After students have had a chance to write their answers, have students pair share their answers with a partner. Having students pair share is a great way to get students comfortable speaking and sharing their opinions in a small group. By pair sharing, students might become comfortable enough to share their response with the whole group. Next, explain to them that by the end of this class they will create their own personal budget.

Class Reading on the Benefits of a Personal Budget

To help students better understand why budgeting is important, have students read an article on the relevance of a budget. The article that I found and used was, “A budget is the first step to financial wellness. Here’s how to get started.” This article is on cnbc.com. Click this link for the article, but if you find another article that fits your classes’ needs feel free to use it!

After students read the article, I had them answer and discuss the following questions, “How does a budget help with financial goals? Why do you think it is more critical to prioritize where you money goes the less money you have? How are wants and needs related to creating a personal budget? What did you learn form reading this article?”

I gave students a few minutes to write down their answers and then discuss their answers with a partner. Again, the hope is that after pair sharing students will feel comfortable sharing their opinions with the whole group.

Creating a Personal Budget

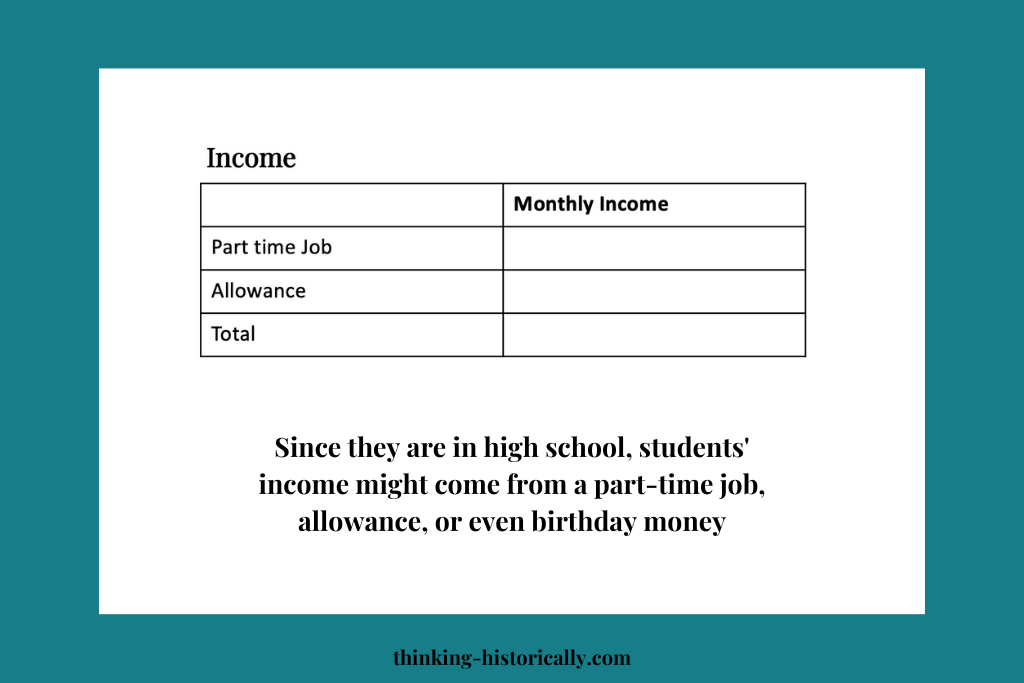

After reading the article, I had students work on creating the personal budgets. I gave students a pre-made budget. At the top of their budget, I had students list their income. (see the sample below). Since they are high school students, their income might come from part-time jobs, allowances, or birthday money.

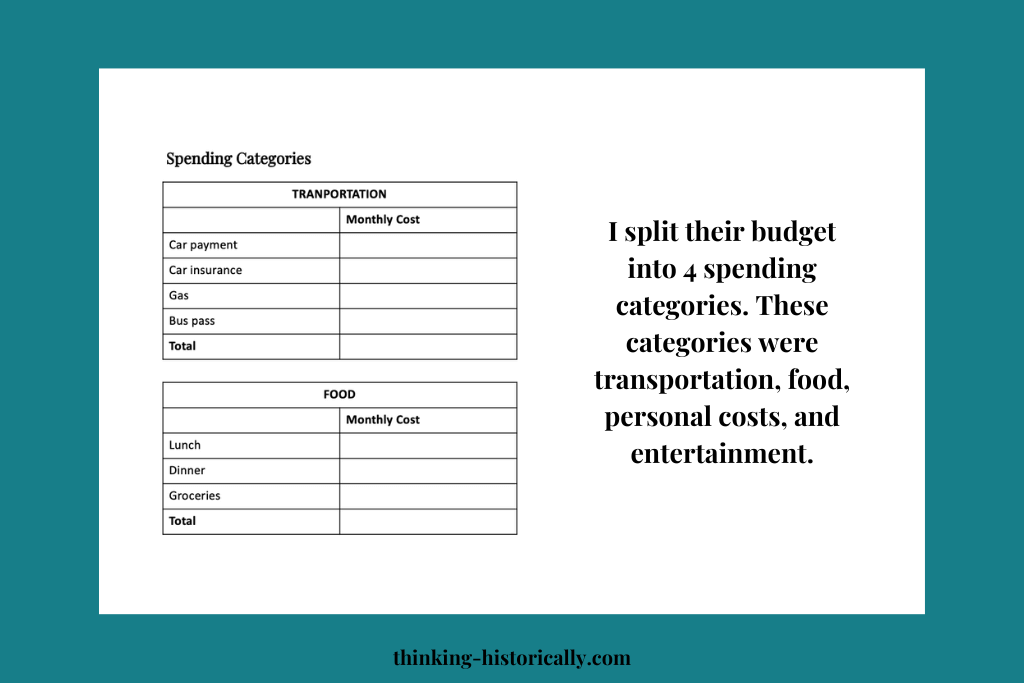

Next I split their budget into spending categories. The spending categories were transportation, food, personal costs, and entertainment (See sample below, but feel free to create your own). After students filled out the budgets, students tallied their total monthly expenses. By tallying their monthly expenses, students will be able to see if they’re spending over or under their monthly income. I gave my students about 15 to 20 minutes to complete their personal budgets.

Reflecting on the Personal Budget

Finally, it is important to have students reflect on their budget. Some questions that I used to help them think about their spending habits were, What did you learn from creating a personal budget? What changes, if any, do you have to make about the way you spend your money?

A great extension exercise to this lesson is to have students fix their budgets. For instance, if they find they are spending too much money, maybe they have to cut back on some spending categories or if they have money left over maybe they are able to go out more with their friends.

Creating a personal budget is a great way to introduce students to financial literacy and how financial literacy benefits them. If you want to buy this lesson, click here. This lesson is also a part of my Economics Financial Literacy Lessons Bundle. This econ fin lit bundle covers personal budgets, credits cards, saving accounts, colleges and student loans. You can browse through my Economics Financial Literacy Lessons Bundle here!