Having financial literacy skills is important in order to make wise choices about how to spend your money or where to invest. However, financial literacy is not often taught in school. Unfortunately, it is often when students graduate college and fend for themselves that they have to figure out the best way to make their money work for them. If you’re a secondary economics teacher, you have an opportunity to teach students about financial literacy! A great place to start is by introducing students to credit cards! With credit cards, students can begin to grow their credit history. This credit card lesson will give students an opportunity to explore different credit card options.

I’ll walk you through my credit card lesson for high school students. You can recreate this lesson for your class or you can purchase the complete lesson here!

Engaging Warm-up

To hook students into this lesson, I start with an engaging warm-up. For this credit card lesson, I use the following warm-up:

It is the end of the year and you have been saving money to buy tickets to your favorite musician’s concert! You’re so excited and already have your outfit picked out. As you’re about to purchase your ticket, you realize that you’re a couple hundred dollars short. You thought you saved enough money. You really want to go to this concert and have already bragged to your friends about going. What will you do? Choose from the following scenarios:

- Borrow money from your parents (you haven’t told them you plan on going to the concert yet).

- Borrow money from your best friend (she/he has a part time job and can help you out!)

- Apply for your own credit card (you currently only have a debit card, but you have a part time job and feel like you can manage your own credit card).

Students like this warm-up because it gets them thinking about money and their favorite musician at the same time!

Most students don’t know much about credit cards yet. They might have heard about the cons or negatives of credit cards, such as credit card debt so it is important to explain to students that there are positives to having a credit card.

The Nitty Gritty of Credit cards

If you have access to the internet, you can show students this optional video. The video gives them a brief rundown on credit cards. The video can be found here. If you don’t have internet access, no problem! You can skip to the reading on credit cards.

This article introduces students to the idea of owning a credit card and discusses the benefits. As students read the article, have them identify the benefits of opening a credit card and the signs that a person is ready to have a credit card. You may have students work individually or in pairs to complete this task.

Credit Card Terms

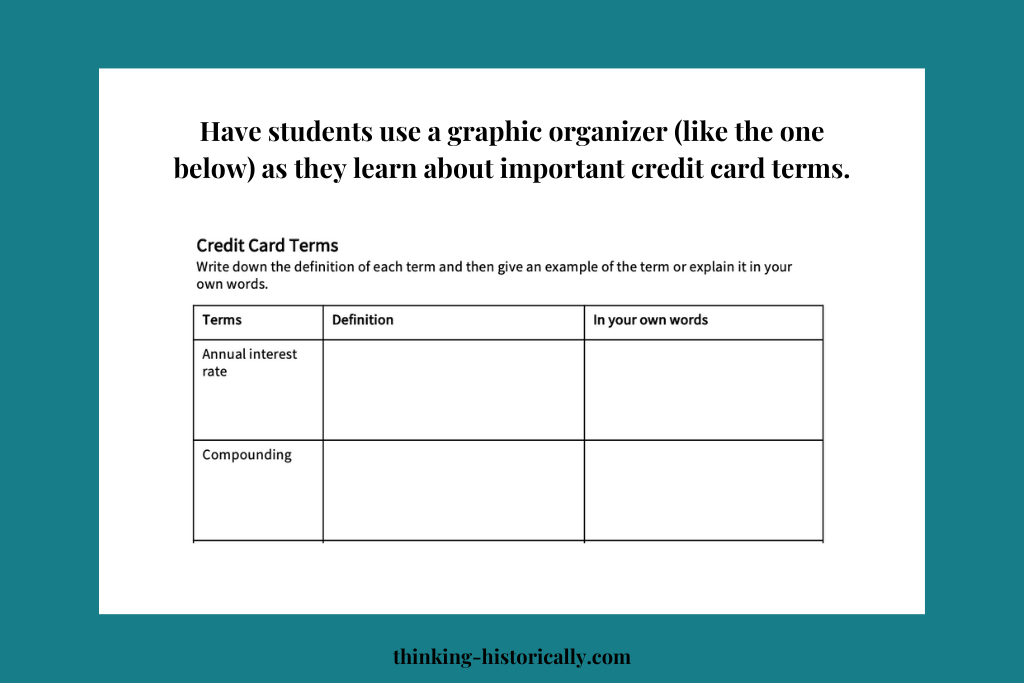

To better understand credit cards, students need to know credit card terms. These credit card terms are annual interest rate, compounding, delinquent payment, grace period, finance charge, introductory rate, and annual fee.

To go over the terms, I simply displayed the definition of each word on the board. Students copied the definitions onto their graphic organizer (see the organizer below for an example) and then created an example of each term. I gave students about 5-10 minutes to complete this portion of the lesson. You can have students work individually or in pairs to create their own examples. Students can share their examples with the whole class if time allows.

It is important that students understand these terms because in the next part of this credit card lesson students will research credit cards!

Credit Card Research

Now it is time to get to the fun stuff! For this part of the lesson, students research credit cards online! The credit cards I have them research are:

- Discover it Student Cash Back

- Chase Freedom Student Credit Card

- Discover it Student Chrome

- Discover it Secured Credit Card

- Citi Secured Mastercard

- BankAmericard Secured Credit Card

The above credit cards are student friendly and great for people applying for credit cards for the first time. You can have students research the above credit cards or you can switch it up if you like!

For each credit card, students must identify the following:

- Annual Percentage Rate (APR)

- Annual Fee

- Credit History

- Rewards

Exit Slip

Once students complete their credit card research, they must decide which card is the best for them. For their exit slip, students answer the following question:

Based on your research, which of the 6 credit cards would you apply for? Why? Explain your answer in the space below.

This is a great introductory lesson to credit cards! You can recreate it on your own or purchase the complete lesson here. The lesson includes complete lesson procedures and student handouts.

Happy teaching!

One Response