If you teach high school seniors, chances are your students have senioritis. I know because I’ve been there and I get it. You might be wondering how to reel them back in with the few months that are left in the school year. If you’re an economics teacher, you can reel them in with this budgeting project! In this budgeting project for high school students, students must make choices between their wants and needs to create a budget that fits their lifestyle!

Even if you don’t teach economics, you can still incorporate this project in this class! It helps students become more financially aware! After all, financial literacy is an important skill to have in order to navigate through life. I’ll walk you through how I did this project in my class. If you’re interested, you can also buy the complete project here!

This project can be done as an in-class project, a take home project, or a mixture of the two!

Budgeting Project Introduction!

The first step is to introduce this project to your students. Tell students that for this project, they have a job and earn $17 an hour ($2,947 a month) AND have $7,000 in their savings account. Students will get excited off the bat because money is involved! Next, explain to students that for the first part of this project they must look for housing/an apartment and look for furniture for their new home.

For their apartment search, students can use apartments.com or Zillow. They must include proof of the apartment listing and include the security deposit and the cost of rent each month. Have students use money from their savings accounts to pay for their security deposit.

Other costs/bills students must include for this portion of the project are:

- Water bill

- Electricity and gas bill

- Cable bill

- phone bill

- Internet bill

Students must also eat. To make it easier for students, have students include $400 a month towards their grocery (you may change this cost to fit your students’ needs).

After students have identified all of the above costs, have them add up all their bills for the month..

Furniture Search

Next, students must find furniture for their apartment. Students will use money from their savings account to furnish their apartment. Furniture items that student may need are:

- Mattress (Bed)

- Bedframe

- Lamp

- Television

- Dining table

- Dining table chairs

- Sofa

- Television stand

- Dishes

- Cups

Students must identify how much each item will cost. Students can purchase other items not listed. Once students have purchased all their furniture for their apartment, have students add up the total cost for all the furniture they have purchased.

Transportation

For this budget project, students work full-time. Since they work full time they will need transportation getting to and from work and to other places. For this portion, students must research transportation options.

Below is a set of questions that will help students think about transportation and conduct their research:

- If you own a car, what kind of car do you own?

- How much is your monthly insurance?

- Based on the car you own, research how much gas is used per mile. Estimate how much do you spend on gas monthly.

- If you take public transportation (bus, subway, train, etc.), include how much you would spend monthly.

- If you don’t drive or take public transportation, explain how you will commute to work and other places.

- Find the total amount you will spend on transportation. Include the total below.

Once students complete their transportation research, have add up their total transportation costs.

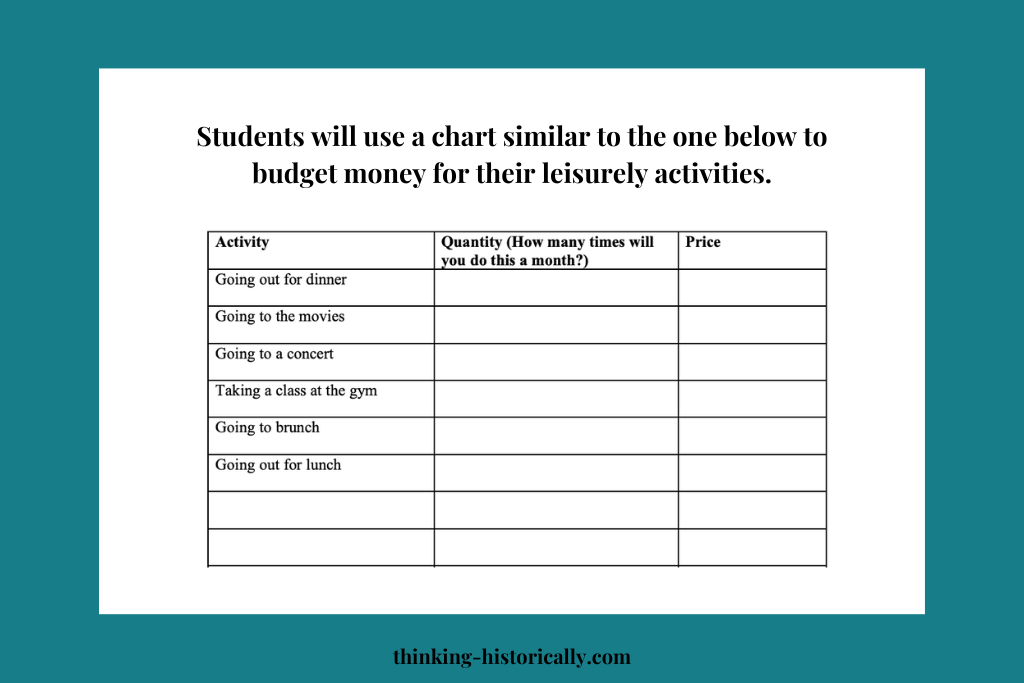

Leisurely time

On their days off of work or over the weekends, students may want to spend time on their own or with their friends doing things that make them happy. Some of the activities that they like are not free. Below is a list of activities that students might do during their leisurely time. Have students complete the chart to find out how much money they need to set aside for their leisurely time. Explain to students that they can include activities not listed on this chart.

Total costs

Once students have found a place to live, bought furniture, researched their transportation, and have set aside money for their leisurely time, it is time for them to calculate their monthly expenses and their monthly income. Remind students that they earn $2947 a month.

Have students add up their totals for housing, transportation, and leisurely time. Once students have calculated their monthly expenses, they must reflect on the following questions:

- Do you have enough money to afford the services (housing, transportation, leisurely time) you use every month? Why or why not?

- If you are not able to pay for your monthly expenses, explain which items or services you would have to give up.

- After paying for the security deposit for your apartment and buying furniture, how much money did you have left over in your saving account?

- Were you able to buy all the furniture you needed and wanted for your apartment? Why or why not?

- Based on this assignment, is an income of $2,947 a month enough? Why or why not? If not, how money would you want to receive in income monthly? Why?

Reflection

The last part of this project is for students to reflect upon their budget. For this portion, students must answer the following questions in at least 2 paragraphs:

- How is economics related to everyday life?

- What did you learn from doing this project? Why?

In their reflection, students must use the following economic terms: scarcity, choices, wants, needs, opportunity costs, benefits, and trade-offs.

This is a fun project for students to do! It helps them think about their spending habits and make changes to it, if necessary. If you want to purchase the complete project, click here. The complete project includes detailed instructions, charts, and ready-to-use student handouts.

Happy teaching!

2 Responses