When I graduated from high school, I didn’t know the difference between a debit card and a credit card. It wasn’t until much after (a little too much after) I graduated from college and got a job that I started putting money aside for my retirement (oops lol). Financial literacy skills are so important, but many of us don’t start thinking about financial literacy until we’re broke and have to (lol). As a high school economics teacher, you have an awesome opportunity to incorporate financial literacy lessons into your class!

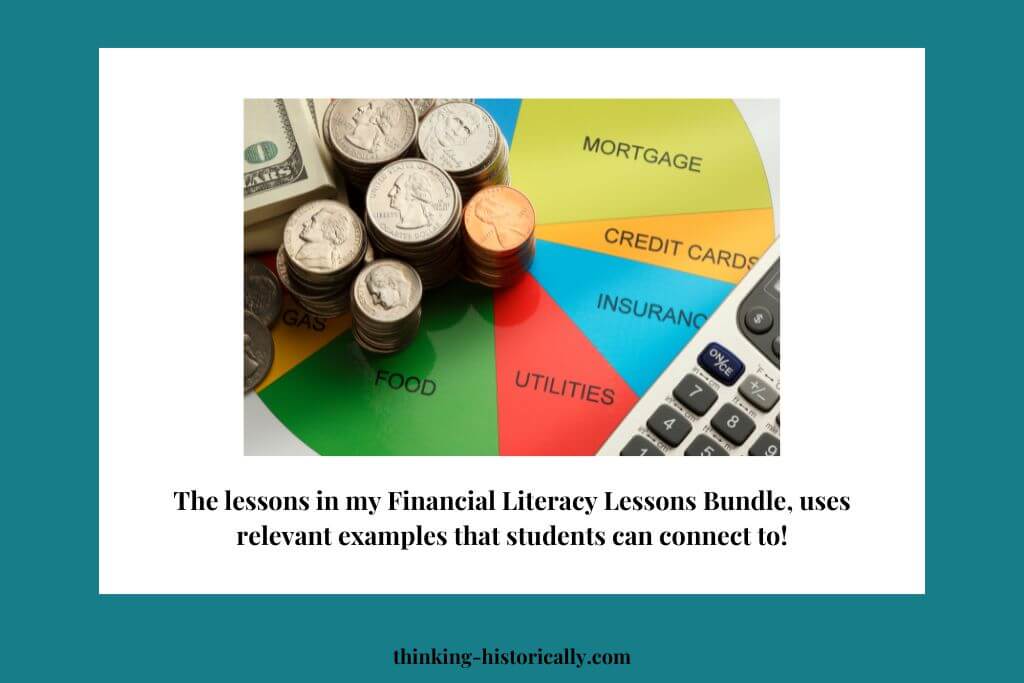

Your students will love the opportunity to talk about money and all things related to money. Another benefit is that incorporating financial literacy will make your economics class come to life! I created financial literacy lessons for my students. They are available in my Financial Literacy Lessons Bundle. The lessons in this bundle use relevant examples that students can connect to!

In this blog I’ll walk you through the lessons in my bundle. You can purchase my Financial Literacy Lessons Bundle. It includes complete lesson plan outlines and ready-made student materials so that you can use the lessons in your class right away!

Let’s dive into these lessons!

Budgeting Lesson

The first lesson in this bundle is on budgeting! Budgeting is an essential skill, unfortunately not many of us are taught this skill and instead wing it (lol). Students begin this lesson by reading an article on budgeting. The article discusses how budgeting is the first step in financial wellness and can be found here.

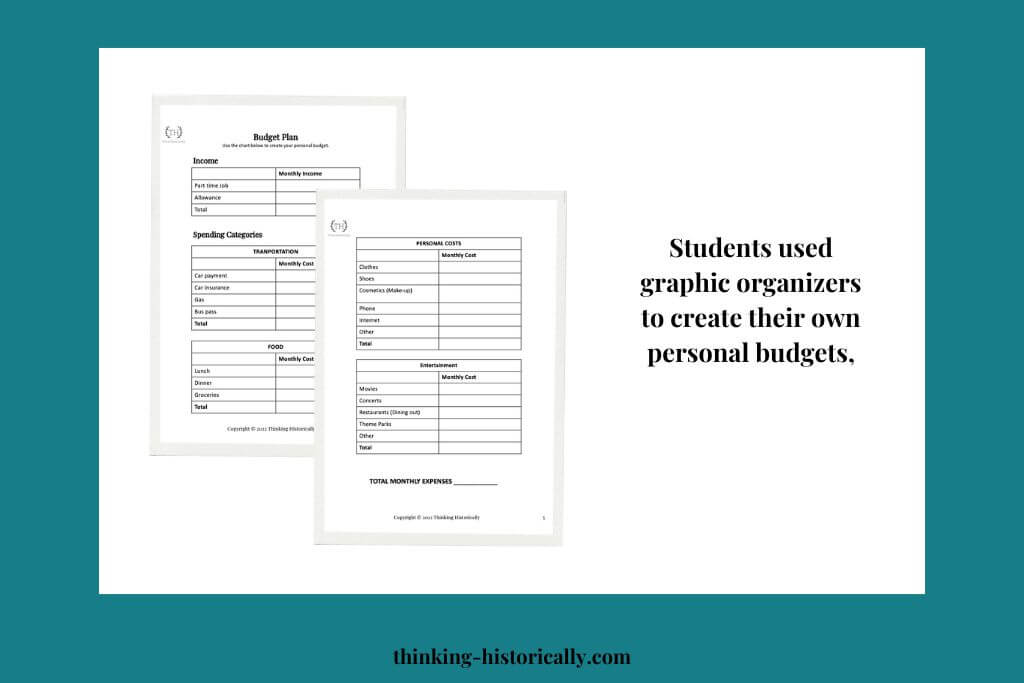

Next, students create a personal budget. Below are examples of graphic organizers that I made for students to create their budgets. Give students about 15-20 minutes to complete this activity.

Finally, close out this lesson by asking students the following questions:

- What did you learn from creating a personal budgeT?

- Are there any changes you have to make about how you spend your money? Why or why not?

- How are the terms “needs” and “wants” related to budgeting?

You may choose to have students write down their answers to these questions or discuss them out loud.

Types of Savings Accounts

The next lesson in this bundle, introduces students to the types of savings accounts that exist. In this lesson, students read an article about 6 types of savings accounts. The six types of accounts are: traditional savings account, high yield savings account, monkey market account, cd account, cash management account, special savings account. The full article can be found here. While students read the article, they complete a graphic organizer to keep track of the saving accounts information.

Next, students are given 6 descriptions of people who want to open savings accounts. Based on their descriptions, students must decide which type of savings account this person must open. If you’d like to read more about this lesson, read my blog post here.

Credit Card Lesson

The next lesson in this financial literacy lessons bundle covers credit cards. This is a fun lesson because there are so many credit cards out there and it can be overwhelming for people, especially students, to decide which credit card to sign up for. In this lesson, students read an article about the benefits of opening a credit card. The full article can be found here.

Then students conduct internet research on various credit cards. The credit cards I had my students research were: Discover It Cash Back, Chase Freedom Chase Credit Card, Discover it Student Chrome, Discover it Secured Credit Card, Citi Secured Master Card, Bank Americard Secured Credit Card.

Finally, students must decide which credit card they would open and why. If you’d like to read more about this lesson, you can read my blog post here.

College Research Project

The last resource in this bundle is a college research project. I love this project because I don’t think people consider it a financial literacy topic, but it is! Especially because students oftentimes have to take out loans in order to attend college.

In this project, students look at the social benefits of attending college and then research different ways to pay for college. Next, students research specific 4-year and 2-year colleges to identify housing costs, tuition, courses offered, and transfer rates at 2-year colleges. Then students research various jobs and occupations and the salaries, type of education needed, and degrees or diplomas necessary to obtain each job/occupation.

If you’re interested in learning more about this project, you can read my blog post here.

Conclusion

Financial literacy is an important skill that goes beyond the high school classroom. As an economics teacher you have a unique ability to incorporate financial literacy lessons into your economics course. Check out my Financial Literacy Lessons Bundle, if you’re interested in purchasing it and using it for your classroom.

Happy Teaching!